Grain Market Morning Comments: March 31, 2020

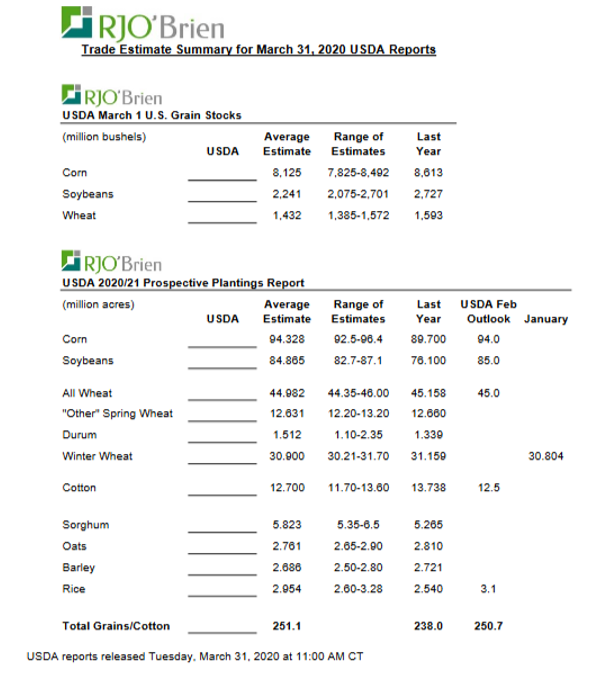

Corn was lower yesterday while soybeans and wheat ended slightly higher. The grain complex is lower across the board overnight as we wait for USDA prospective plantings and quarterly stocks. I will attach a worksheet with estimates on the second page. The dollar has rebounded the last two days after multiple down sessions last week. Short term it is hard to see the dollar make a significant move lower and will stay very strong against most world currencies. The acres report is expected to stay inline with USDA Outlook numbers while the balance sheets need to see acres drop in both corn and soybeans to get prices to push higher in the short term. It is also month end so some profit taking may be in store too.

Today’s Corn Outlook: Corn settled 4.75 cents lower yesterday and is off another penny today. The corn market is not expecting any good news from today’s reports. We were in an oversupply situation before this ethanol debacle but these early numbers are expected to change as we move forward. Brazil is 99% planted for 2nd crop corn but 1/3 of that area is currently dry. Contract lows will be in play if the numbers are inline to slightly bearish.

May Corn Technicals: The corn market is bearish territory and continues to blow thru technical support. A close under 3.35 ½ will open up 3.18 on the downside. Bulls need to see a close over 3.55.

Today’s Soybean Outlook: Beans settled .75 of cent higher but was off 4 cents overnight. China beans prices are strong while palm oil was softer overnight. Soybeans have been strong lately and should be firm unless there is a bearish surprise in the reports. Soybean meal market should have continued strength and there are logistic problems in SA although China continues to book cargoes out of Brazil because they are cheap. Brazil is 76% harvest on soybeans.

May Soybean Technicals: The soybeans are short term bullish and a close above 8.90 will open up a challenge of 9.00 and 9.10. Bears need a close under 8.61.

Exports: none to report.

Weather: Midwest near to above average rains will limit progress. One third of Brazil 2nd corn crop area is dry. Argy is in good shape but will get dry in the 6-12 day.

Dollar Index: The dollar is trading 44 ticks higher this morning at 99.72. Brazilian Real: The Real is trading 7.5 ticks lower this morning at 19.63.

Additional Comments:

Click here to download the PDF version of this report.